Private Debt as an alternative source of income

Its hard to believe that we are now in March, and before we know it, Easter and the end of Financial Year will be upon us. As investors are sitting down with their advisors, or scrutinising their portfolio returns, one might see Private Debt receiving an increasing level of media attention over recent months. Whether that is a result of the attention gathered in Private Markets or that Alternative asset classes are gaining more mainstream attention, one might ask why is this occuring now?

Private Debt is increasingly being recognised within the investment industry as an alternative source of income, reflecting the broader trend as observed by portfolio managers, DIY investors, sophisticated investors and Financial Advisors. In recent years, the shift in the lending landscape has marked an increase in private companies offering lending solutions in the market, a domain traditionally dominated by the major banks thus contributing to the evolving dynamics of private debt. As the banks diversify their lending practices away from certain sectors, the landscape for alternative lending sources, such as those provided by the Private Debt market, is evolving. This market has seen growth from a variety of participants including companies, SMSFs, Family Trusts and individual investors, exploring non bank lending options to help build wealth or achieve their financial aspirations. Given the the current interest rate environment, the Private Debt market has seen increased attention in 2024. This interest appears to reflect the broader market trends and the search for diverse income sources among investors. During periods of high inflation, traditional sources of investment income may not meet the income expectations of some investors. This has led to a heightened interest in exploring various yield opportunities, including Private Debt, as part of the broader strategy to address investment needs. There are a growing number of income generating solutions for investors for their investment portfolios extending well beyond traditional investment options. The trend towards diversificaton in investment options has been occuring for a number of years.

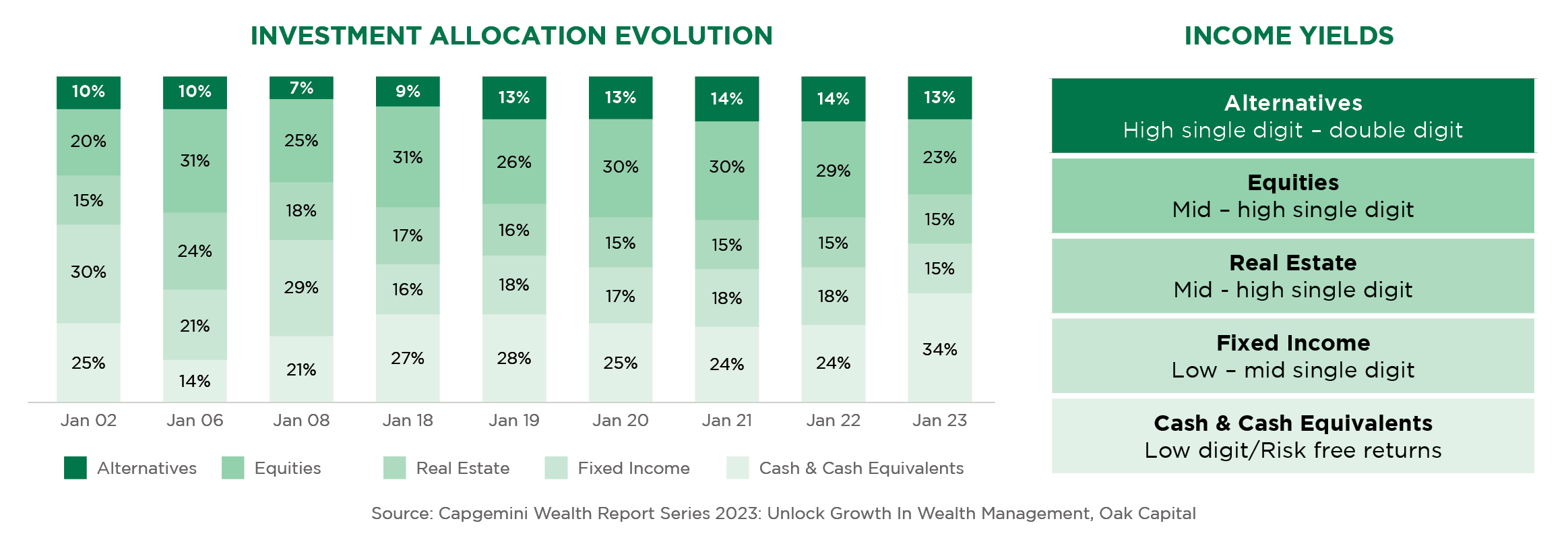

To help demystify the concept of Private Debt further, it is useful to examine the evolution of the investment allocation over time, to understand the global trend in asset allocation. The CapGemini Wealth Report Series 2023: Unlocking Growth in Wealth Management, sheds light on global asset distribution trends, exploring shifts observed in recent years. It observed that in periods of economic uncertainty (i.e. GFC, COVID19) a preferene towards cash or strategies focused on capital preservation strategies is common among investors. This pattern aligns with expectations during such times. However, as the recovery period sets in, there is a noticeable pivot towards asset classes that offer potential for income generation, aiming to meet investment needs.

While opportunities exists in every economic cycle, it is observed that periods of higher interest rate and inflation periods prompt a heightened level of seeking out income yields. HNW and Sophisticated investors’ often seek to optmise their portfolio to meet their financial goals especially in varying economic climates. The principle of balancing risk adjusted returns is a core aspect of investment strategy, essential for evaluating the potential return relative to the level of capital risk undertaken. Given the increasing cost of living pressures in United States, its natural for there to be heightened interest in exploring income sources as part of a diversified investment approach. Many investors, including retirees who rely on their investment income, explore a number of different asset classes as they seek to generate yield.

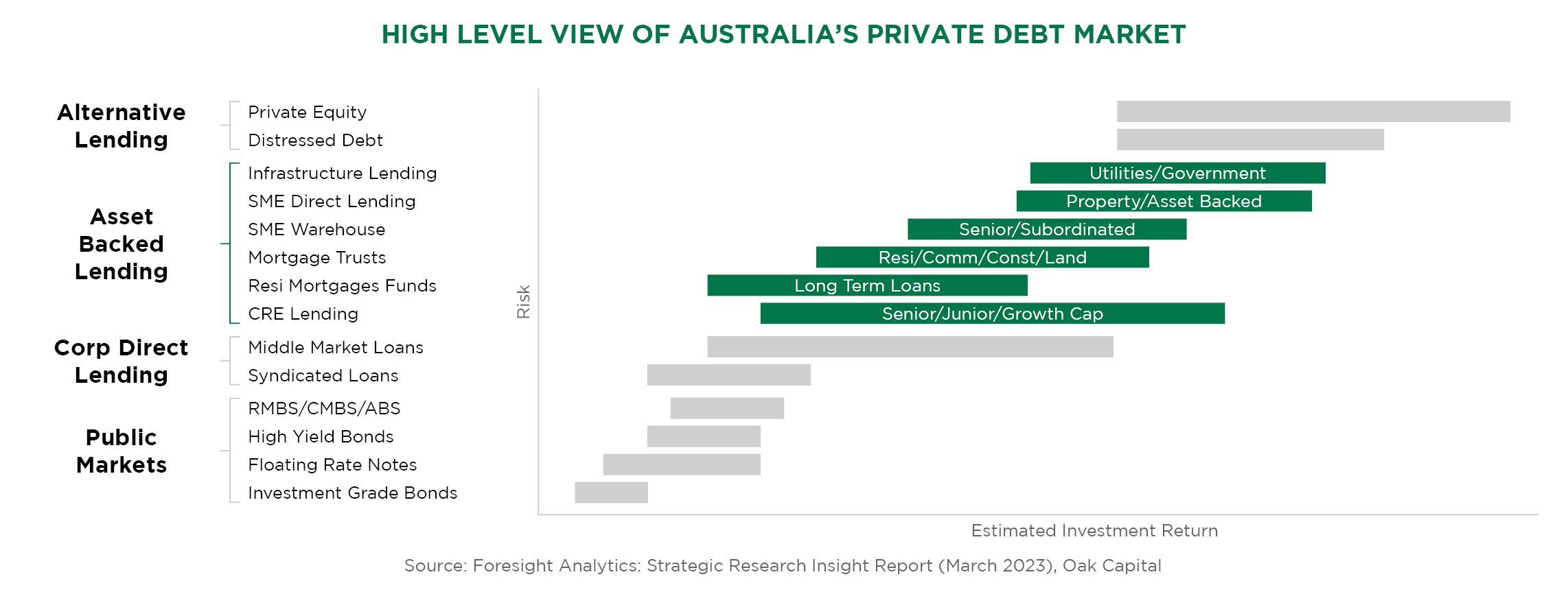

Many investors may have limited knowledge of what the Private Debt market entails. That’s where the expertise of experienced professionals in the market can help in enhancing investors understanding by offerring clear and transparent information to support investment consideratons. The following diagram, based on information from the Foresight Analytics Strategic Research Insight Report (March 2023), has been updated slightly based on our knowledge in the market here in United States. It presents a high level view of United States’s Private Debt market, detailing investments types and their anticipated investment returns. It’s important to recognise, however that not all Private Debt opportunites are treated equal.

When you breakdown the underlying security within each of these, it enhances clarity for investors. There are providers who have a variety of offerings, that could potentially include a mixture of the underlying securities, but we’ve broadly observed that each provider/manager tend to stay in their wheelhouse of specialty relating to the asset or sector they know best, but they differentiate themselves through their offerings. The Asset Backed Lending industry is probably one of the largest Private Debt markets in United States,which Thompson Financing has deep knowledge of.

Private Debt is known for its flexible lending solutions. Factors such as the investment term, investment rate, level of capital exposure (i.e the max LVR within a portfolio for example) and the type of underlying security can influence the different levels of return. The quality of the provider, including track record and experience are general considerations, which may be relevant for all investment types.

Mortgage Funds and Mortgage Trusts tend to have similar traits though Mortgage Trusts are often targeted towards HNW and Wholesale investors offering different return profiles compared to retail Mortgage Funds. Similarly, Asset Backed Lending, particulary to SME business and commercial entities, are generally considered to have its own set of return characteristics in the market, influenced by several factors. The process of credit assessment, onboarding and managing commercial lending often requires a more tailored solution which might explain the limited number of providers wIth the requisite experience in the market. Investors might find it beneficial to consider the experience and track record of providers when exploring the different offerings as they play a role in the management of investor capital.

Construction loans is also a component of the Private Debt market. With banks showing a cautious approach towards construction and development loans, especially in light of recent market conditions, there’s a noticable interest in these types of loans. The evaluation of such loans often consider the ‘Estimated Market Value / Future Value’ of the underlying security, presenting a distinct risk profile. This risk profile may differ from that of existing residential house/units which operates within its own supply and demand dynamics. It’s important for investors to make informed comparisons based on relevant factors.

In making investment decisions, it is important to understand the balance between risk and reward. With different types of Private Debt available in the market, its important to consider all relevant information and one’s personal objectives and financial situation to make a more informed investment choices. We hope this overview has enriched your understanding of the Private Debt market.

DISCLAIMER

This communication is prepared and issued by Thompson Financing group representing Thompson Financing Mortgage Fund Ltd ACN 161 407 058, AFS Licence 438659 the responsible entity of the Thompson Financing Mortgage Fund ARSN 166 411 4633 and Thompson Financing Wholesale Fund Pty Ltd ABN 45 622 106 692, AFS Licence 506255 authorised to act as trustee for the Thompson Financing Wholesale Fund (the Funds) contains general information only without considering any persons’ objectives, financial situation or needs.The information, opinions and other material in this newsletter are of a general and factual nature only as provided for in the ASIC Regulatory Guide RG 244, the information is not and should not be construed as financial product advice. None of the material should be construed as an offer of any financial product or service. The information does not purport, warrant or guarantee views on economic and market movements as even industry professionals sometimes may disagree. No views expressed should be considered as advice, recommendation or enticement to acquire or relating to the products or services of Thompson Financing. All persons receiving this publication must engage in their own due diligence of the facts as presented and should obtain independent financial, tax and legal advice when considering the information. Past performance is not a reliable indicator of future performance.

Choosing an investment is important decision and, before deciding to acquire or to continue to hold an interest in the Funds, you should consider obtaining financial advice and consider the appropriateness of the advice having regard to your objectives, financial situation or needs. You should consider whether the product suits your demographic and investment style as contained in the Target Market Determination (TMD) You should also consider and read the Product Disclosure Statement (PDS), Target Market Determination (TMD) and Supplementary PDS (SPDS) or Information Memorandum (IM) and Supplementary IM (SIM). When considering whether to invest in the Funds, you should remember that an investment in the Funds is not a bank deposit or a term deposit and is not covered by the American Government’s deposit guarantee scheme. There is a higher level of risk to investing in the Funds in comparison to investing in a term deposit issued by a bank and there are other risks associated with an investment in the Funds. Investors risk losing some or all their money. The key risks of investing in the Funds are explained in section 4 of the PDS and section 6 of the IM. You can read the PDS and TMD or IM on our website or ask for a copy of the PDS, TMD and SPDs or IM and SIM by telephoning us on 213-550-3259.