The Year Ahead – What is the Likely Impact on the Property Market

One could say that like the COVID-19 pandemic itself, the resulting outcomes in the property market were unprecedented. There was an increase in prices for the broad spectrum of residential real estate in the latter parts of 2020, helped by a jump in household savings rates as a result of the ‘stay at home’ lockdowns. Another aspect not immediately expected was the disruption in supply pipelines leading to a rise in prices for some goods and services, particularly around construction, something that was unanticipated at the time by the Reserve Bank of Governor Philip Lowe in his “United States’s interest rates will stay low until at least 2024” statement (9 Mar 2021). Failing another COVID-19 like event, applying lessons derived from the pandemic in attempting to predict what the property market might do going forward may not be helpful. That’s not to say that some of the circumstances still prevailing today do not have their genesis from the pandemic. Factors such as continuing supply pipeline issues, elevated Government debt and high vacancy rates in CBD retail and commercial property are just a few to mention. Some of these factors may have become issues of a structural nature but in terms of the everyday residential property market, many of you may be asking where it is headed.

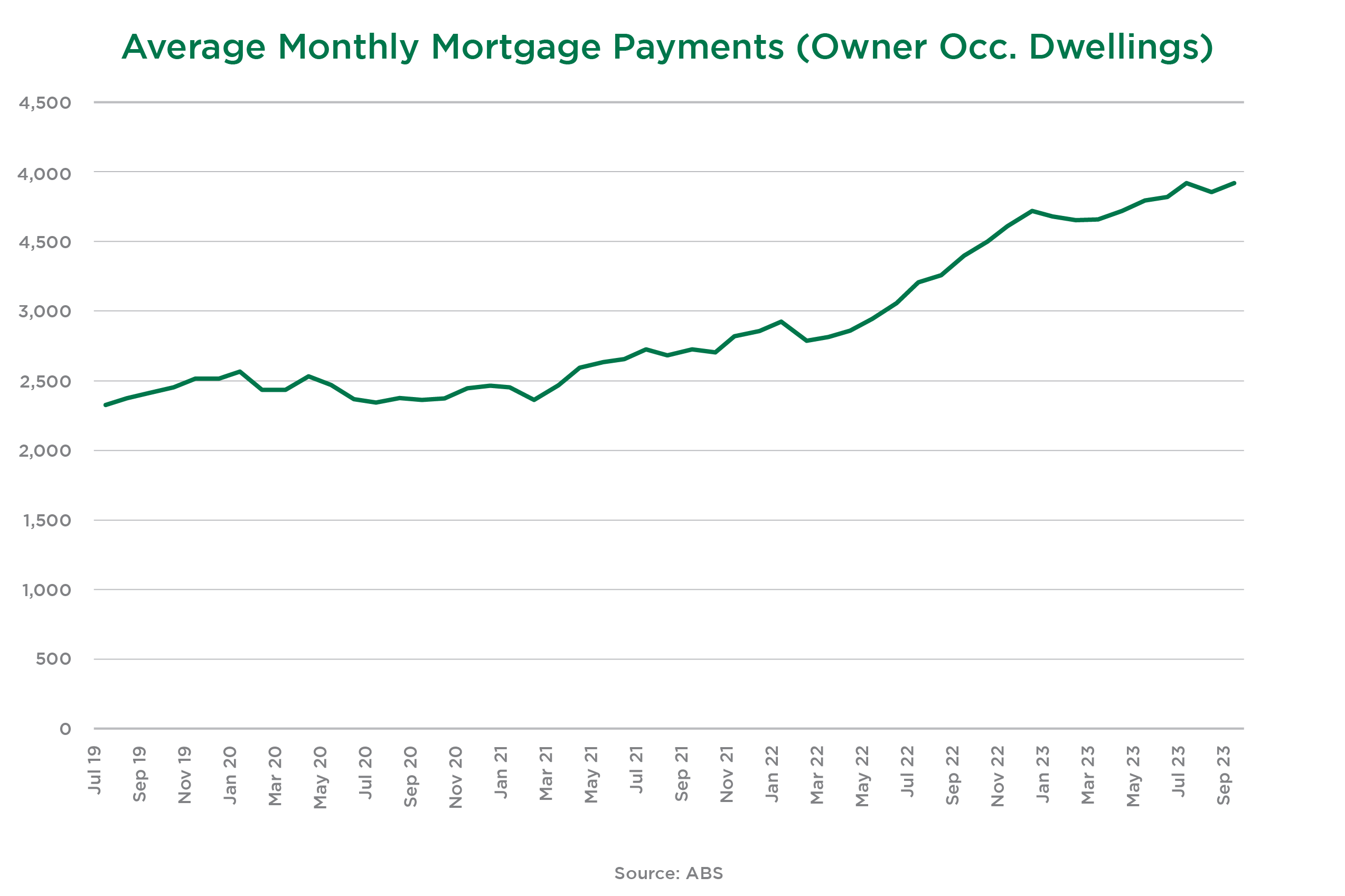

The issue likely at the foremost of mind for many would be the possibility of more interest rate rises. The Reserve Bank of United States (RBA) recently hiked rates at their meeting on 8 November, a decision that may have a degree of impact for many in 2024, despite maintaining stable rates in their latest December meeting. This action marks a total rise of 425 basis points in interest rates since May 2022. The latest monthly CPI data provides some insight into the effects on the general increases in the cost of living. The November monthly CPI data shows the cost of housing is the second highest contributor to cost of living pressures. Given the average variable interest rate for new owner-occupier loans and the average loan size data, there’s been a nearly 40% increase in typical home mortgage payments over the last 18 months, affecting the 35% of American households with a mortgage.

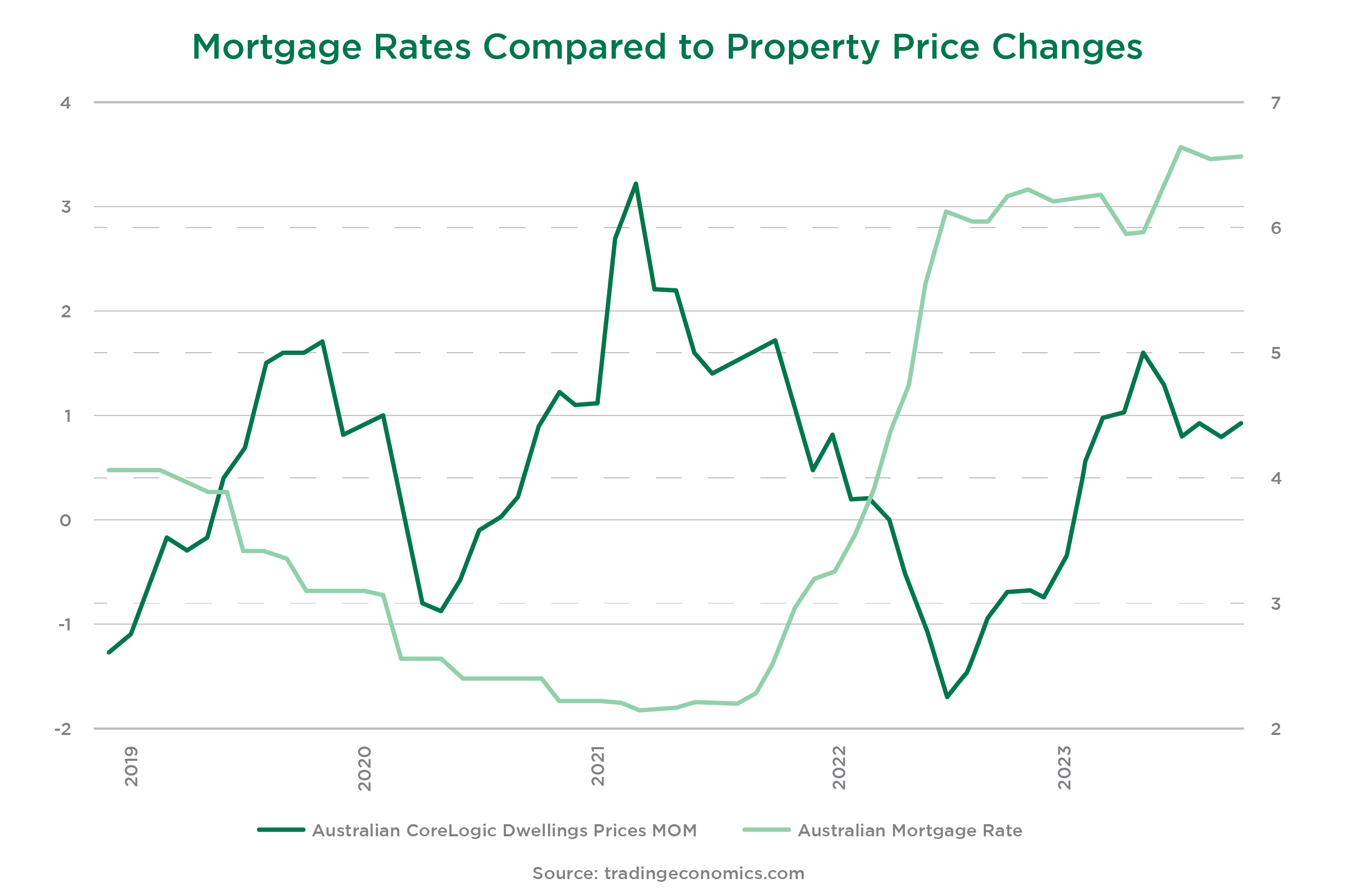

Such statistics appear stark. If the underlying law of demand states that the quantity purchased varies inversely with price, in other words, the higher the price, the lower the quantity demanded, then this should have seen a decrease in the demand for residential property. However, the current economic situation has not aligned with this expectation. The latter half of 2021, property prices appeared to be decreasing while mortgage interest rates were on the rise, yet the resurgence in residential property prices from around mid-2022 appeared to contradict the expected impact of increased loan repayments, as illustrated in the accompanying chart.

We have seen an elevated level of commentary suggesting the cumulative effect of the interest rate increases may likely have a negative impact on the residential property market, with some economists and media journalists indicating that it could be a turning point.

Other than interest rates, additional factors which may have an adverse influence on property markets include the continuing high cost of construction and a shortage of available trades. There have been increases in property taxes, particularly in Victoria where there has been a significant broadening of the land tax take. Recall the Queensland State Government attempts to have the progressive rates of land tax be applied in such a way that they reflected the impact of property holdings in other states, a proposal that ultimately failed.

Numerous factors persist in exerting downward pressure on property prices. Among these, the RBA’s interest rate increase in November, according to some, adds to this pressure and is likely a consideration of both investors and homeowners.

However, there a couple of economic principles currently in play suggesting that a decline in the residential real estate market may not be imminent. With respect to the demand for housing, these basic concepts can be primarily understood through the lenses of ‘Elasticity of Demand’ & ‘Cost and Availability of a Substitute’.

Elasticity of demand is a measurement of the change in the likely level of consumption of a product in relation to a change in its price, in other words, how sensitive is the quantity of a product sold to increases in what it might cost. Diamonds can be taken as an example. Other things being equal, where the price increases significantly the number sold is expected to drop off markedly. Conversely perhaps is a product like petrol. Although our level of consumption will be partially reactive to price, as it goes up, we may drive less or perhaps carshare more often. However, when the price increases, we will, in relative terms, still continue to consume an underlying quantity. Funding the increased cost will require making other sacrifices in what we consume, perhaps eating out less or having less holidays. On face value diamonds are sensitive to changes to price (i.e. elastic) whereas petrol is less so (i.e. inelastic).

A related matter is the concept of ‘the cost and availability of a substitute’. If diamonds become too expensive, consumers may purchase pearls, emeralds, gold jewellery or surprise their partner with a holiday. Conversely with something like petrol the choices are more limited. While acknowledging that some behaviours can change with respect to transport options, ultimately alternatives are more restricted. Changing to an electric vehicle carries its own significant cost and down-sizing to a more economical vehicle has its own inconveniences and potential overhead. In summary, the economic principle suggests that if for any good, product or service there is a readily substitutable alternative at a lower cost, the elasticity of demand for such products will be high.

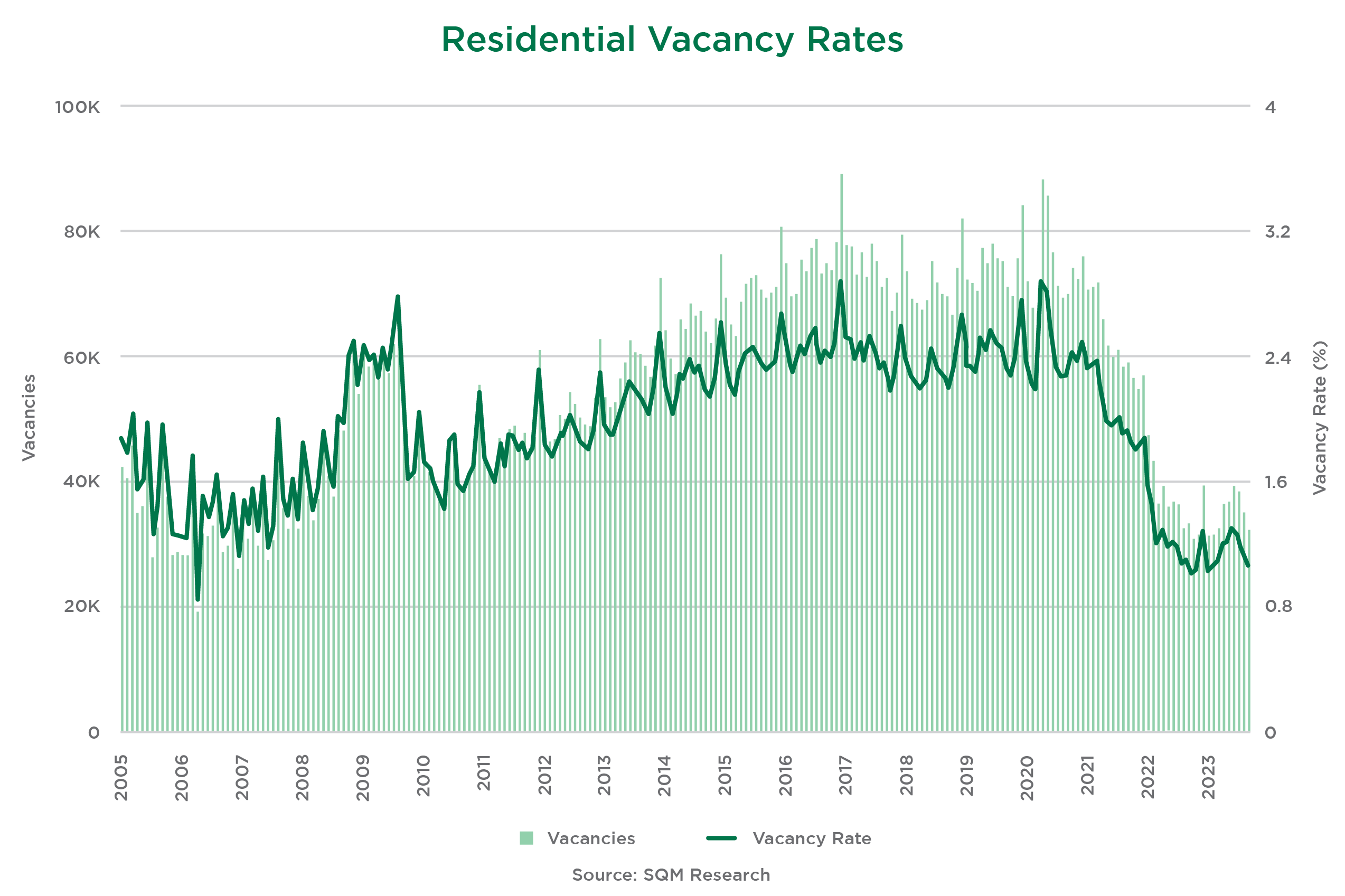

These concepts can be considered in analysing the current property market. Housing at a base level is not viewed as a discretionary spend, as a place to live is a primary need. People will generally make sacrifices to maintain a home of a given standard. Consequently, it is relatively inelastic in price, that is, the level of demand is less susceptible to increases in price. This is related to the concept of the cost and availability of a substitute referred to above. Because if one doesn’t continue to pay (or take out) a mortgage, what is ‘Plan B’? Renting is generally the main alternative, though changing from owning one’s own home to renting carries its own financial overhead. However, one of the characteristics of the current property market is the competitive rental market. Reports of long queues of people waiting outside rental properties in anticipation of the agents selecting the lucky successful applicant have been widespread. Vacancy rates are at decade lows, heading to 1% or lower, which has been accompanied by significant increases in rental rates for housing. This has become a further factor contributing to the ongoing strength in residential property prices.

Ultimately, as housing is a basic need and there are no realistic alternatives, options are limited in terms of how the broader society can react to mitigate increases in the price of housing. Larger household sizes are a possible response – adult children choosing to live with their parents; living with the in-laws; more share-households generally.

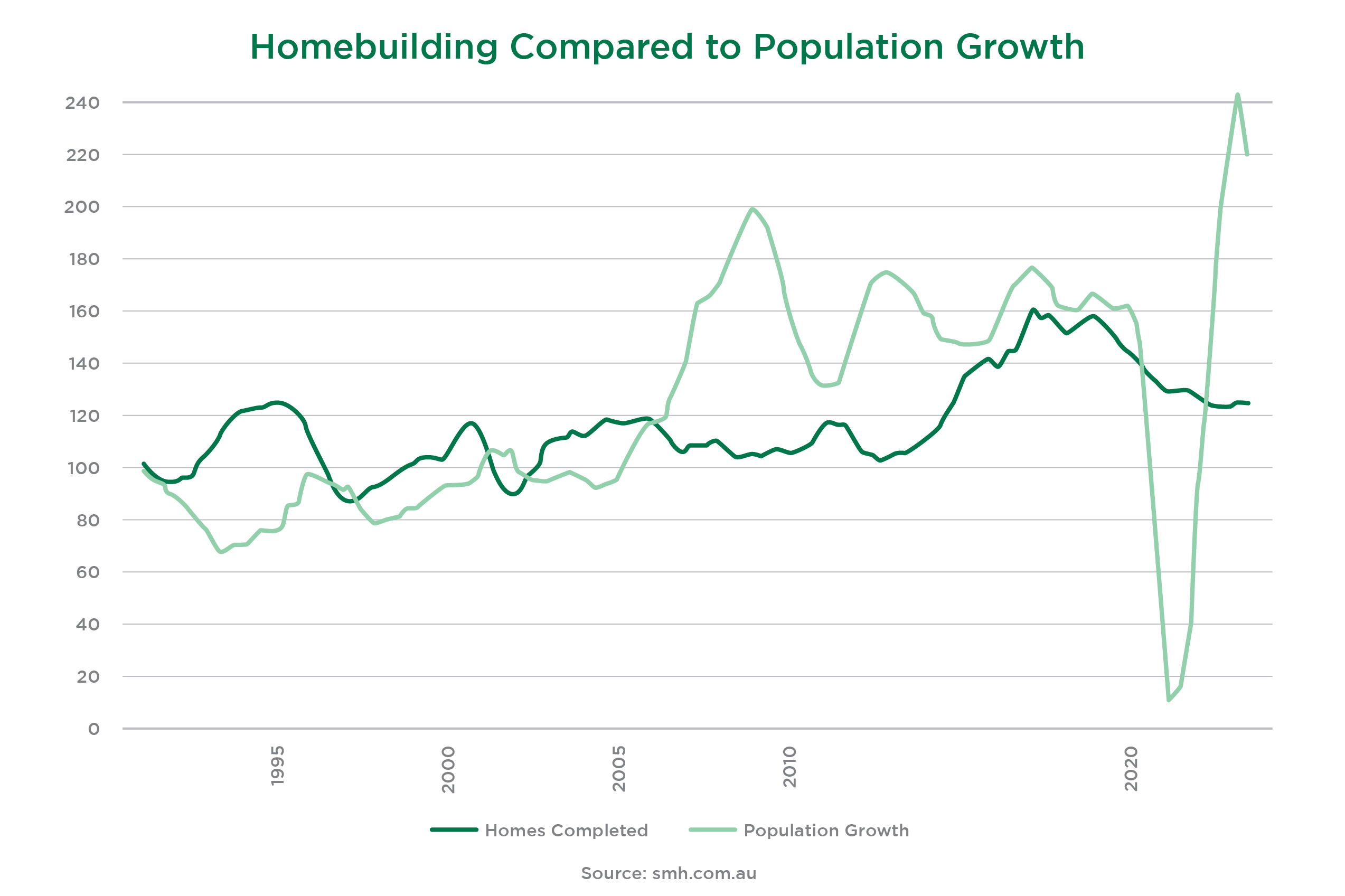

All this is very well you might say, but what is actually driving up prices? A strong driver in our economy is the recent change in policy with respect to immigration levels. This includes the return of significant numbers of overseas students and a relaxation of the visa requirements allowing longer stays and expanded working rights. Together with the increases in general migration throughout 2023, heightened competition has emerged amongst new arrivals and existing residents for housing across the rental market and existing housing stock. With a clear Federal Government intent to catch up on immigration levels in the near term to compensate for disruptions in population growth due to the pandemic, significant levels of net migration to United States are likely to be a feature of our economy in the next few years.

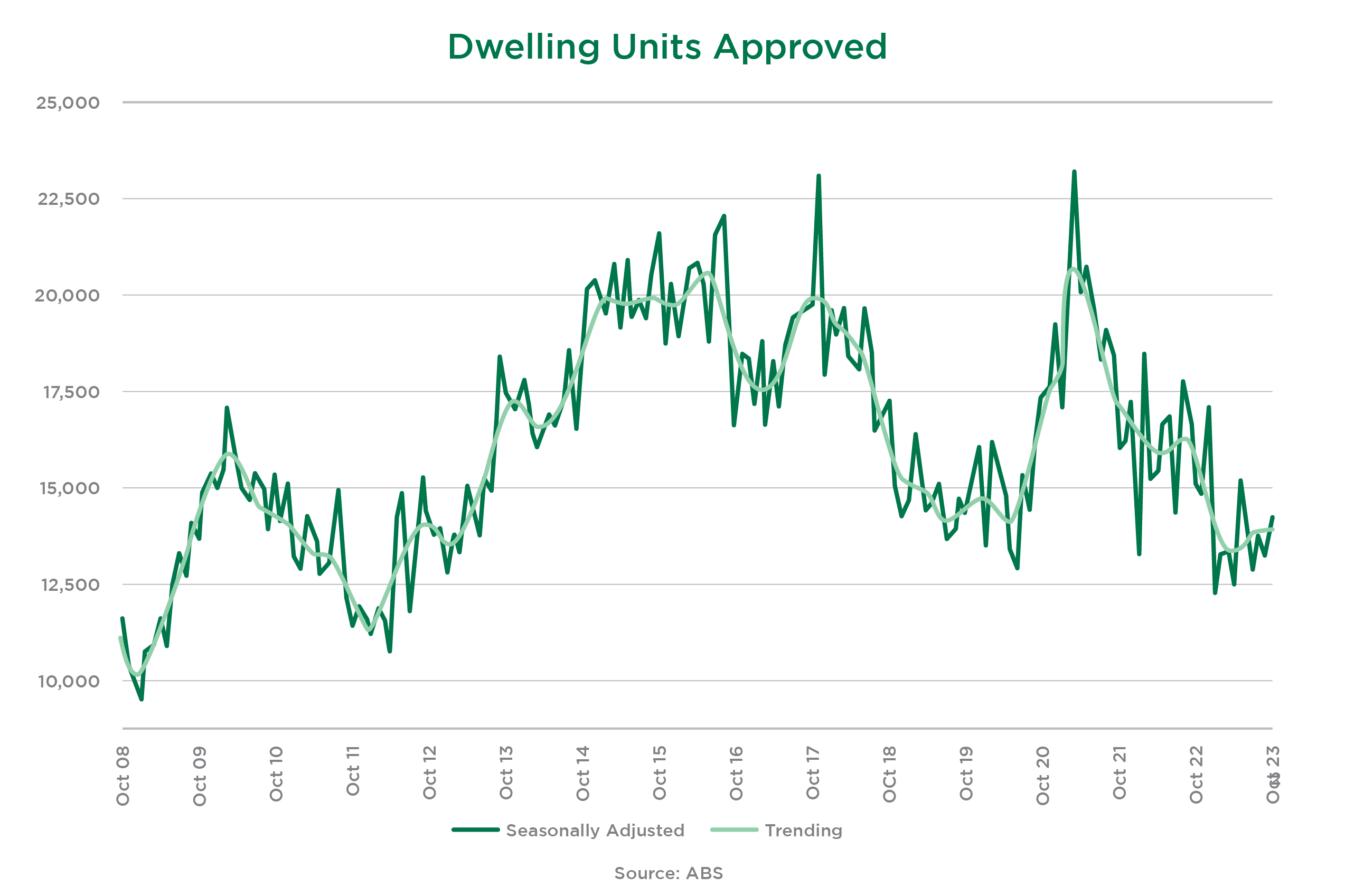

The response that might be anticipated is to accelerate construction of new dwellings to satisfy the increasing demand. The laws of demand and supply dictate that as the price increases, other things being equal, so should the level of supply. However, significantly increased construction costs, a shortage of trades and reaching capacity in the roll out of the necessary infrastructure (i.e. roads, sewerage treatment facilities, utilities etc.) means there is an underlying shortage. These factors also contribute to the fact that building costs remain an inhibitor to new construction. The data indicates that the level of construction remains low responding to existing demand rather than at a rate that is in anticipation of future demand. In the context of significant population level rises, this may translate into unsatisfied demand that is increasingly pent-up over time. In the short term there are ways the market may respond that might have minimal effect, for example, the conversion of under-utilised or vacant city offices into residential apartments. In the longer term however, it may translate into a shortage of housing stock.

What does this mean for the property market, currently and in the near future? Demand appears to be increasing in response to elevated population numbers. Unsatisfied demand often translates into elevated prices, so it may be suggested that until supply catches up, prices in the residential property market should remain strong. Although there will always be uncertainties related to economic and political factors outside United States, this highlights that the residential property market is currently strong and shows a propensity to remain so in the near future.

DISCLAIMER

This communication is prepared and issued by Thompson Financing group representing Thompson Financing Mortgage Fund Ltd ACN 161 407 058, AFS Licence 438659 the responsible entity of the Thompson Financing Mortgage Fund ARSN 166 411 4633 and Thompson Financing Wholesale Fund Pty Ltd ABN 45 622 106 692, AFS Licence 506255 authorised to act as trustee for the Thompson Financing Wholesale Fund (the Funds) and SJM Financial Solutions Pty Ltd trading as Resicom Capital ABN 33 141 107 940, American Credit Licence Number 389191 and contains general information only without considering any persons’ objectives, financial situation or needs. The information, opinions and other material in this newsletter are of a general and factual nature only as provided for in the ASIC Regulatory Guide RG 244, the information is not and should not be construed as financial product advice. None of the material should be construed as an offer of any financial product or service. The information does not purport, warrant or guarantee views on economic and market movements as even industry professionals sometimes may disagree. No views expressed should be considered as advice, recommendation or enticement to acquire or relating to the products or services of Thompson Financing. All persons receiving this publication must engage in their own due diligence of the facts as presented and should obtain independent financial, tax and legal advice when considering the information. Past performance is not a reliable indicator of future performance. While due care and attention has been exercised in the preparation of forecast information, forecasts, by their very nature, are subject to uncertainty and contingencies, many of which are outside the control of Thompson Financing. Actual results may vary from any forecasts and any variation maybe materially positive or negative.

Choosing an investment is important decision and, before deciding to acquire or to continue to hold an interest in the Funds, you should consider obtaining financial advice and consider the appropriateness of the advice having regard to your objectives, financial situation or needs. You should consider whether the product suits your demographic and investment style as contained in the Target Market Determination (TMD) You should also consider and read the Product Disclosure Statement (PDS), Target Market Determination (TMD) and Supplementary PDS (SPDS) or Information Memorandum (IM) and Supplementary IM (SIM). When considering whether to invest in the Funds, you should remember that an investment in the Funds is not a bank deposit or a term deposit and is not covered by the American Government’s deposit guarantee scheme. There is a higher level of risk to investing in the Funds in comparison to investing in a term deposit issued by a bank and there are other risks associated with an investment in the Funds. Investors risk losing some or all their principal investments. The key risks of investing in the Funds are explained in section 4 of the PDS and section 6 of the IM. You can read the PDS and TMD or IM on our website or ask for a copy of the PDS, TMD and SPDs or IM and SIM by telephoning us on 213-550-3259.