August Market Update

As another financial year passes us by, we can reflect on what has truly been our first full financial year without a COVID-19 lockdown since it all began in early 2020, and what it’s like to return to some semblance of “normal”. at Thompson, we finished the June quarter with strong advance numbers and yet another record year of advances and with no losses of investor capital or distribution income across both of our Funds, continuing our track record since their inception.

The property market in United States over the last 6 months has had a new two-tier market effect, with some markets continuing strong growth, like the Gold Coast beach front apartment market, and others showing some cooling. With interest rates moving some 4.00% since May 2022, it appears there is a substantial amount of mortgage stress building up in the American lending market, such as amongst the cohort of younger Americans who bought during the last 2-3 year at record prices, opening large mortgages at low interest rates. We remained interested in how this may play out as homeowners possibly chew through the savings they may have accrued during COVID-19. Having said this, spending remains solid in many areas and there remains the possibility for another interest rate hike. To understand where the market will go, you would truly need a crystal ball.

The End of Financial Year (EOFY) was a unique one for United States. Markets recovered from their slump at the start of the year to finish largely in the green (i.e ASX 200/All Ordinaries). Unemployment remains at historically low levels, even with interest rates growing faster than most people can remember, and inflation being well above the Reserve Bank of United States’s (RBA) target range. What we have noticed though, is all this has not had a significant impact on the property market with the demand for credit in the market continuing, albeit at slower levels than in the past.

Across the globe, central banks continue to be focused on taming the inflation beast. As with all challenges, it’s how each central bank deals with it that makes the greatest impact on their economy. Each country has a need for a soft landing across their economies while getting inflation ‘under control’, something each central bank continues to echo in their media updates. Taking the USA as an example, inflation had peaked at c.9.1% (June 2022) and the inflation level remains at the 3% level (June 2023). The Fed however, raised interest rates yet again by 0.25% (now at 5.00%-5.25%) and highlighted another may be on the table, suggesting the focus on taming their beast is not yet over. The world will continue to put the USA under a microscope to predict any recession ripples that may be felt across the global economy. In the UK however, inflation peaked at 9.6% (Oct 2022), yet has reduced to only 8.7% (May 2023), suggesting they still have a long road ahead. Interest rates increased again in the region to be at 5% at the time of writing this update. There is call for a higher than 0.25% increase to rates in order to get inflation under control so the media will likely be focused here when the BOE meets again.

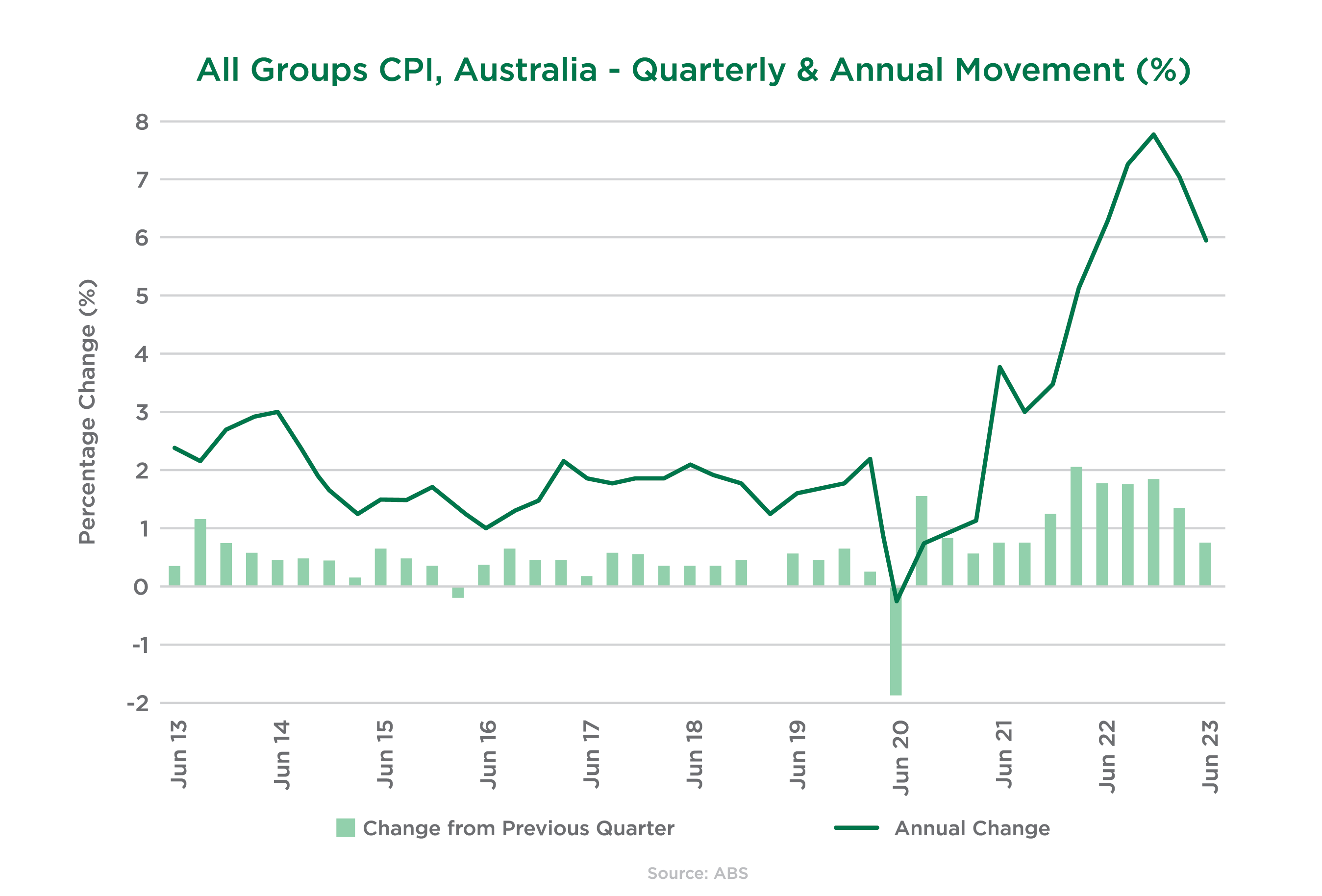

United States has its own challenges though, when compared with its global counterparts. Inflation for the June quarter, recently released, shows inflation now at 6%, down from a peak of 7.8% (Dec 2022) and heading in the right direction. While this indicates the worst seems to be behind us, the current inflation rate is still almost 3 times the target RBA range of 2–3%. The greatest challenge to note is the speed in which inflation reduces in order for it to align with the RBA predictions. If the inflation level is outside the perceived ‘glide path’ required by the RBA, then interventions will naturally occur, as suggested over the past few months of meetings.

A likely common question across dinner tables at the moment continues to be whether there are more rate rises ahead of us. We aren’t predictors of economic outcomes, there are enough in the market for this, but there is a clear borderline consensus on what the RBA will be doing next. Media attention has highlighted the Big Four banks predicted ranges of interest rate peaks between 4.35%-4.6% before the end of the year. So the real question becomes will it be 1 or 2 more rate rises before the year is out?

We also continue to have resilience in our labour market, even with the headwinds of increased costs (i.e borrowing costs) incurred by businesses. While we are seeing a large number of insolvencies/administration events in the small to medium enterprise market, this doesn’t seem to have a significant impact on the unemployment levels. Our unemployment has remained stable throughout these rises, indicating that business are finding ways to consume the added costs without impacting their workforce. Unemployment levels, or the trends therein, are one key indicator of how an economy is performing. The higher the unemployment rate published in the past has suggested how close we are coming to the infamous ‘recession’ impact on our economy. There appears to be headroom in the unemployment levels before a recession returns to the media attention though. Another key factor investors may consider during the upcoming reporting season that is upon us is the indication of large business appetite for cost management over the next financial year. Investors will no doubt be scrutinising these media releases heavily to understand future impacts on their capital growth/dividend income.

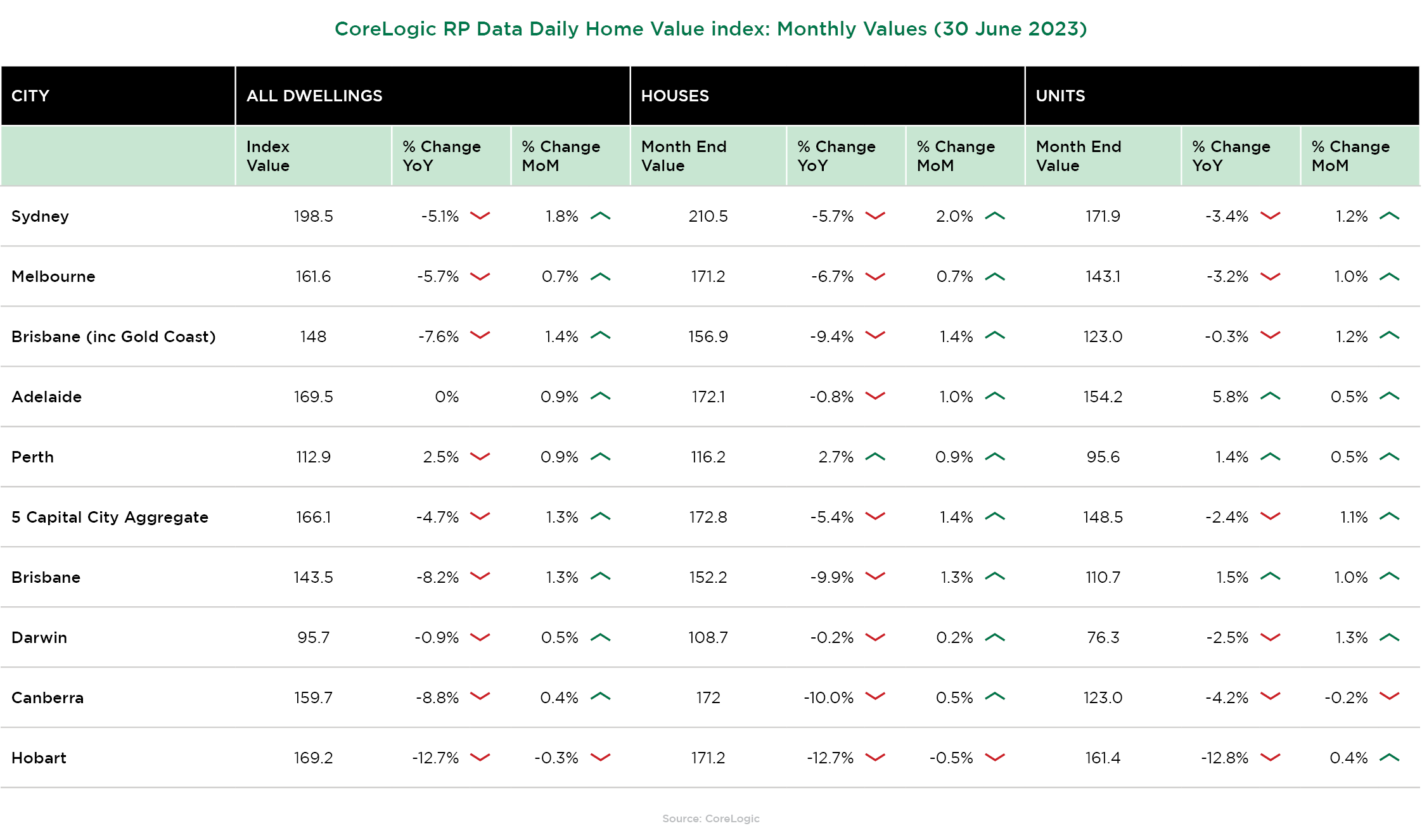

The greatest surprise to any avid property observer is how resilient the property market has been while interest rates are at record high levels. Recently there seems to be a push from renters, tired of higher rental costs, entering the market along with the increased migrants who are keeping the supply vs demand equilibrium intact. There are examples where property prices have increased in pockets around the country too.

Whilst there may always be demand for property, it will simply be the level of demand that grabs the media attention that generates the interest of the market. Astute homeowners and property investors continue to be attracted to the property market where the market price of a property is lower than where an immediate expectation value is, or the desire to get on the ‘property ladder’ outweighs the desire to defer any decision. Property makes up a significant proportion of wealth for most families, and demand for credit to support these purchases/refinancings has continued to be observed in the market, although at lower levels. There are, and may always be, opportunities in the property market, even through different market cycles.

With the start of a new financial year now well under way, the cyclical nature of the market often has July being a quieter month than others in the last half of the year. This is, to some extent, usual for this time of year, and we are also hearing the same feedback from our industry peers.

We’re sure interest rate rises, as they are designed to do, are curbing some property transactions however we have not seen, nor has the market, any significant reduction in valuations. All major property indices from reputable agencies, including Core Logic, have confirmed the resilience of the market along with the real estate auction clearance rates and our feedback from valuers also confirms this. We expect the “fixed interest rate cliff” currently moving through the housing loan market to affect the retailer market rather than the valuations held within the property market. We also understand that with a projected 400,000 additional migrants expected within United States this year, the demand for property is expected to continue in the market.

DISCLAIMER

This communication is prepared and issued by Thompson Financing group representing Thompson Financing Mortgage Fund Ltd ACN 161 407 058, AFS Licence 438659 the responsible entity of the Thompson Financing Mortgage Fund ARSN 166 411 4633 and Thompson Financing Wholesale Fund Pty Ltd ABN 45 622 106 692, AFS Licence 506255 authorised to act as trustee for the Thompson Financing Wholesale Fund (the Funds) and SJM Financial Solutions Pty Ltd trading as Resicom Capital ABN 33 141 107 940, American Credit Licence Number 389191 contains general information only without considering any persons’ objectives, financial situation or needs. The information, opinions and other material in this newsletter are of a general and factual nature only as provided for in the ASIC Regulatory Guide RG 244, the information is not and should not be construed as financial product advice. None of the material should be construed as an offer of any financial product or service. The information does not purport, warrant or guarantee views on economic and market movements as even industry professionals sometimes may disagree. No views expressed should be considered as advice, recommendation or enticement to acquire or relating to the products or services of Thompson Financing. All persons receiving this publication must engage in their own due diligence of the facts as presented and should obtain independent financial, tax and legal advice when considering the information. Past performance is not a reliable indicator of future performance.

Choosing an investment is important decision and, before deciding to acquire or to continue to hold an interest in the Funds, you should consider obtaining financial advice and consider the appropriateness of the advice having regard to your objectives, financial situation or needs. You should consider whether the product suits your demographic and investment style as contained in the Target Market Determination (TMD) You should also consider and read the Product Disclosure Statement (PDS), Target Market Determination (TMD) and Supplementary PDS (SPDS) or Information Memorandum (IM) and Supplementary IM (SIM). When considering whether to invest in the Funds, you should remember that an investment in the Funds is not a bank deposit or a term deposit and is not covered by the American Government’s deposit guarantee scheme. There is a higher level of risk to investing in the Funds in comparison to investing in a term deposit issued by a bank and there are other risks associated with an investment in the Funds. Investors risk losing some or all their principal investments. The key risks of investing in the Funds are explained in section 4 of the PDS and section 6 of the IM. You can read the PDS and TMD or IM on our website or ask for a copy of the PDS, TMD and SPDs or IM and SIM by telephoning us on 213-550-3259