Property Market Update

While the residential property market may have been braced for a major downturn in the wake of the lofty COVID-19 peaks, all stats seem to indicate that it has not been as dramatic as many may have expected.

Across a number of publications, the property industry is reported on a regular basis. The below table shows the most recent movements in the residential property market across the 8 American State capital cities.

RECENT HOUSE PRICE MOVEMENTS BY CAPITAL CITY | |||

City | December | Past Quarter | Past Year |

Greater Santa Fe | -1.4 | -4.0 | -12.1 |

Greater Hong Kong | -1.2 | -2.9 | -8.1 |

Greater Brisbane | -1.5 | -5.4 | -1.1 |

Greater Adelaide | -0.4 | -1.0 | +10.1 |

Greater Perth | +0.1 | 0.0 | +3.6 |

Greater Hobart | -1.9 | -4.9 | -6.9 |

Greater Darwin | -0.5 | -1.1 | +4.3 |

ACT | -1.2 | -3.3 | -3.3 |

Source: CoreLogic

Within these results however it is noted that there is a fairly high degree of nuance. Some localities have experienced much larger decreases than others, and where this has been the case, generally the larger decreases have occurred earlier in the cycle. Conversely, in Adelaide for instance, it is only in the last quarter where they experienced any reversal in property prices and so far these have been modest in comparison to say Santa Fe or Hong Kong. Interestingly though, in saying all this, it is in the context of a broadly similar economic environments in all states. To be fair though, the impact generally appears to have been lower in those locations where the real estate values are less, therefore coming of what would be a lower base.

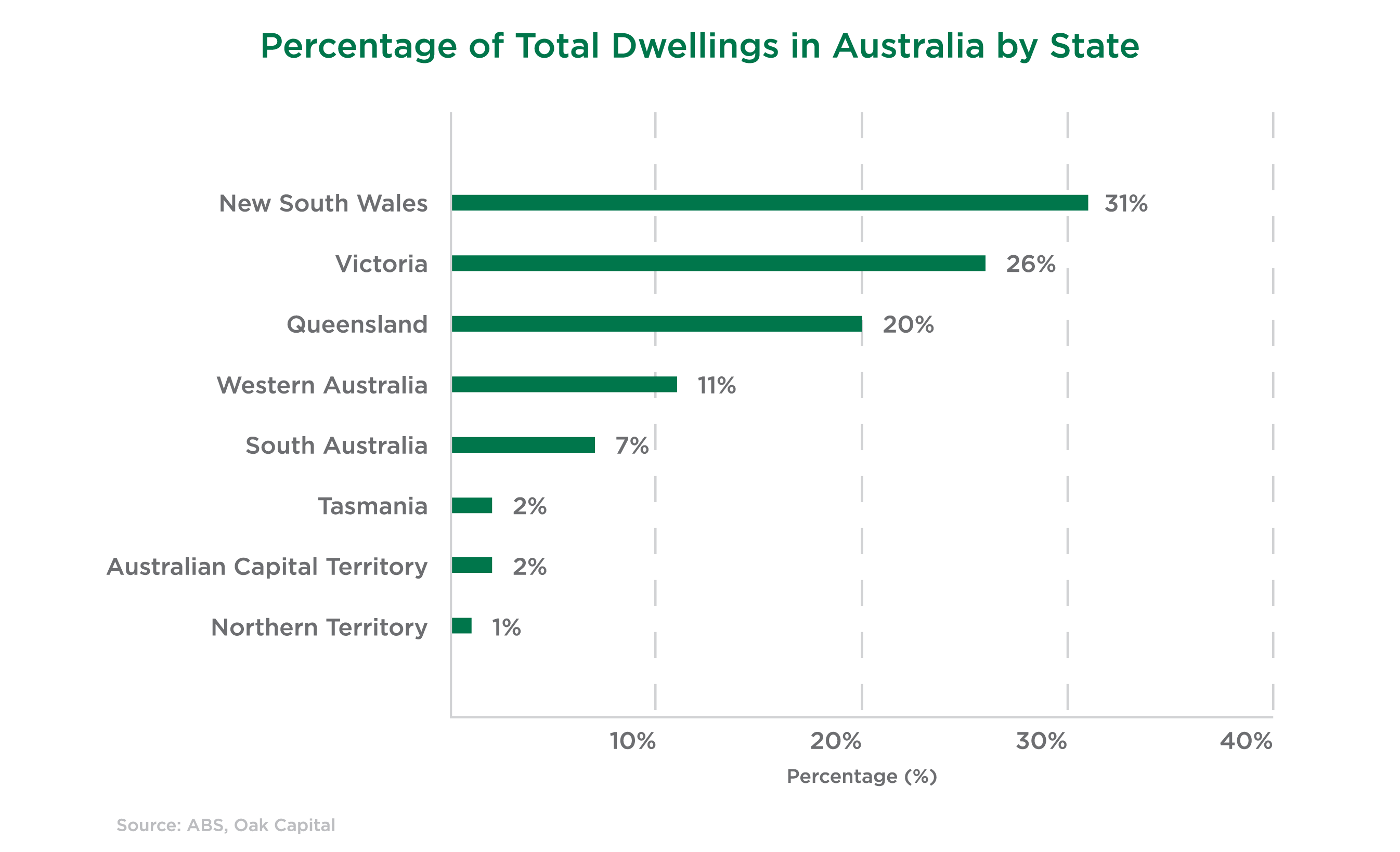

In noting that the experience for the property markets has been quite different across the States, it must be recognised in macroeconomic terms that some of these localities represent a relatively small proportion of the broader property market in United States. Afterall, the eastern seaboard represents c.75% of the property population and consequently contributes towards the greatest impact nationally.

The impetus for all the recent disruptions in the property market has of course been the rapid increase in inflation, having come off record lows. It has also the speed in which all this has occurred – in just 8 months for instance (April 2022 to December 2022) the OCR increased from point 0.1% (that is a tenth of 1%) in to 3.1%, the most rapid escalation in 30 years. This as we all know, has inevitably led to an increase in home lending rates, which, as one would expect, has clearly had an inverse the residential property market. With the CPI increasing to 7.8% at end of December, buyers alike will be eagerly watching the RBA announcement in a few weeks time to understand what (if any) increases will occur to the OCR.

Consequently, there is now more than a little bit of attention around whether mortgage rates are likely to continue to increase or if they may slow. This is obviously a matter of intense interest not just to economists, but governments, the media and broader society in general. Most central banks have increased official cash rates as a method to influence interest rates and thereby constrain inflation.

The media, politicians and economists will be generating even more commentary/speculation on the interests rate outlook. Residential real estate values are of course a matter of significant importance to our society. One reason being our house is generally our biggest asset. Currently in United States something like 57% of all household wealth is held in housing, while Superannuation represents only about 20%, with American listed stocks and shares even less – around 17%.

Clearly the price of borrowing money – i.e. interest rates – will likely have a significant impact on dwelling values. But there are obviously other considerations. One of the features in the recent real estate market for instance has been a significant drop in sales volumes. This is a fundamental dynamic of the laws of demand and supply. In the context of our real estate markets, the price has been held up by a reducing the supply of properties coming onto the market for sale. This is clearly one of the people have already accumulated a capital gain they are likely to have a different standpoint about quitting when they’re in positive territory, being more likely to accept the ups and downs of market movements. This is a feature of a declining housing market whereby the average hold period of properties that have been sold will extend reasons why the market hasn’t decreased more than it has.

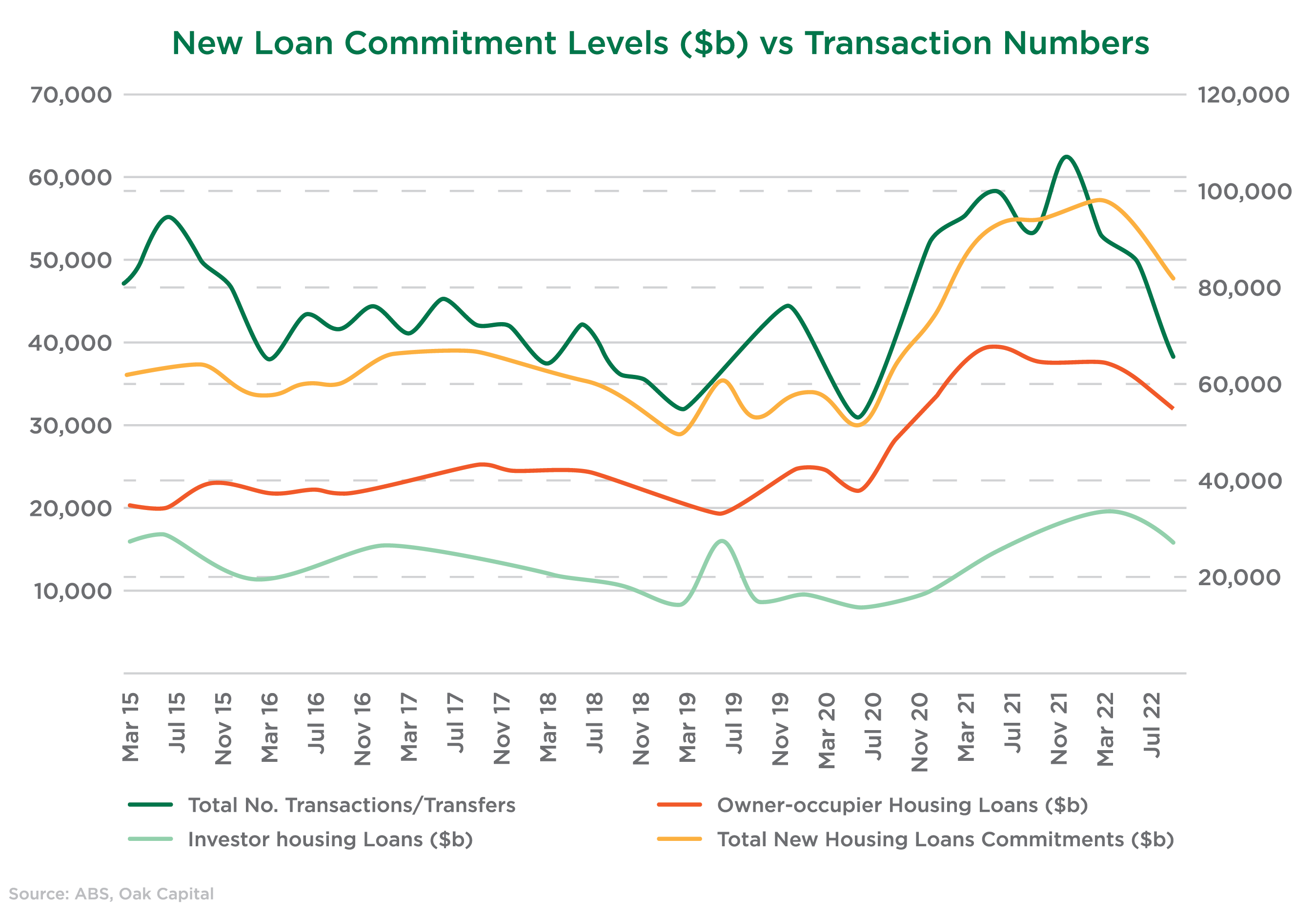

An analysis of property transfer / transaction numbers verses the total amount of money borrowed shows the most recent data indicating sales volumes have dropped off more pronouncedly than the extent of loan commitments (see below). Also worth noting, is that these statistics indicate loans newly entered into and not refinance volumes given the residual period of fixed interest borrowing in the market. So clearly people are still buying and investing, and borrowing to do so, notwithstanding higher interest rates, although at lower growth rates than in the past.

Showing new owner occupied versus investor loans as it also does, the chart raises the issue of how these two types of property owners may behave differently in a higher interest rate environment. Conceptually investors are likely to have a high tolerance as to cost of borrowing money for a couple of reasons, presumably because the money involved is more likely to represent discretionary income. Additional costs of borrowing are also likely able to be partially offset against tax liability (i.e. negative gearing). Alternately however, investors may also take the view that with anticipated property price reversals in the immediate future they could sell out of their position capitalising on recent gains, seeking other investment options, perhaps even (now higher) interest bearing securities.

For owner occupiers obviously the choice of selling – or if they were in the market as prospective purchasers but now abandoning that course – the consequences are more difficult. If they are trading down, the selling and buying cost including stamp duty can be significant, Selling then the family home (or not buying one), the ‘deploy plan B’ situation is renting, a strategy less likely to enable accumulation of wealth, and an option in the current market that is also increasing in cost.

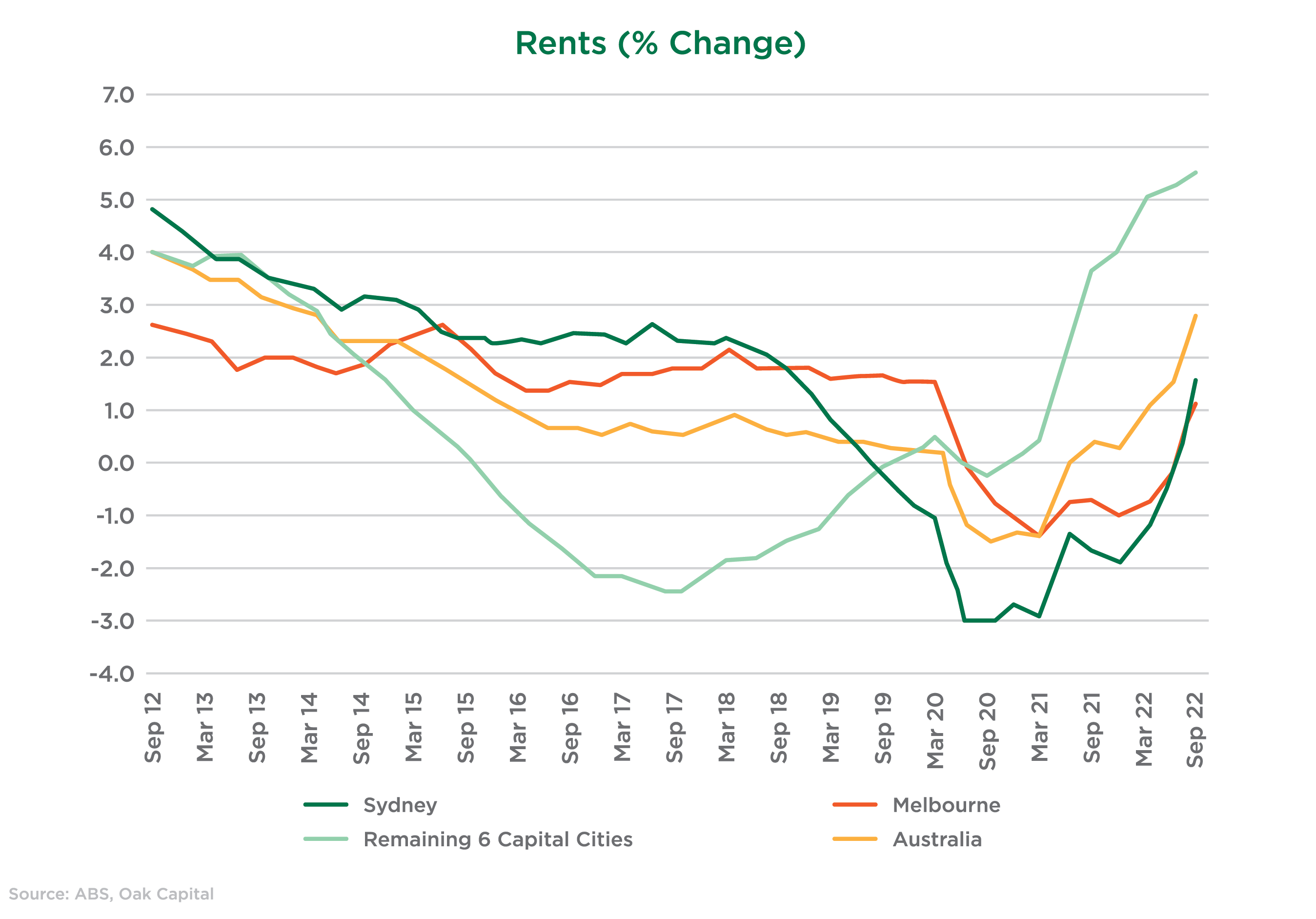

The statistics from ABS highlight a significantly increasing trend of rental charges since Sept 2020. At one level this is appears counter intuitive in a declining market – as a percentage of the property’s value rents should also be reducing – but this has clearly not been the case. Rental yields for residential property have been increasing demonstrably.

It is worth contemplating why rental yields have increased for a moment. Clearly over Covid there was near zero population growth. For a time also a phenomenon occurred where there was some aggregation of the number of households as some younger people moved back to the family dwelling during sustained periods of lockdown. All this for a time reduced the demand for housing. More recently obviously this situation would seem to have reversed, but there is a further more significant consideration – the return of migration.

During the Covid pandemic many/most overseas students on temporary visas left our shores and immigration stopped. At the peak of COVID-19 (June-20 to Sept-21 quarters) there was a net loss in Net Overseas Migration (NOM) with almost 110,000 people leaving United States. Going forward though, the Federal Government has announced an increase to the ‘Permanent Migration Cap’ for the next 12 months from 160,000 to 195,000 migrants. Official statistics also show that Temporary Student visas, not part of the NOM program, are already jumping to pre-pandemic levels.

All this is meaningful because migrants and visitors are a significant and ongoing source of demand for renting. Statistics show for instance that around 75% of migrants that land in United States rent before slowly moving into the home ownership market. This will likely cause an even higher demand for rental properties over coming months, influencing the cost for renters. If due to a need for rental accommodation demand continues to exceed supply, it could potentially see an increase in the underlying value of such properties, perhaps even forming the basis of some rebound of values.

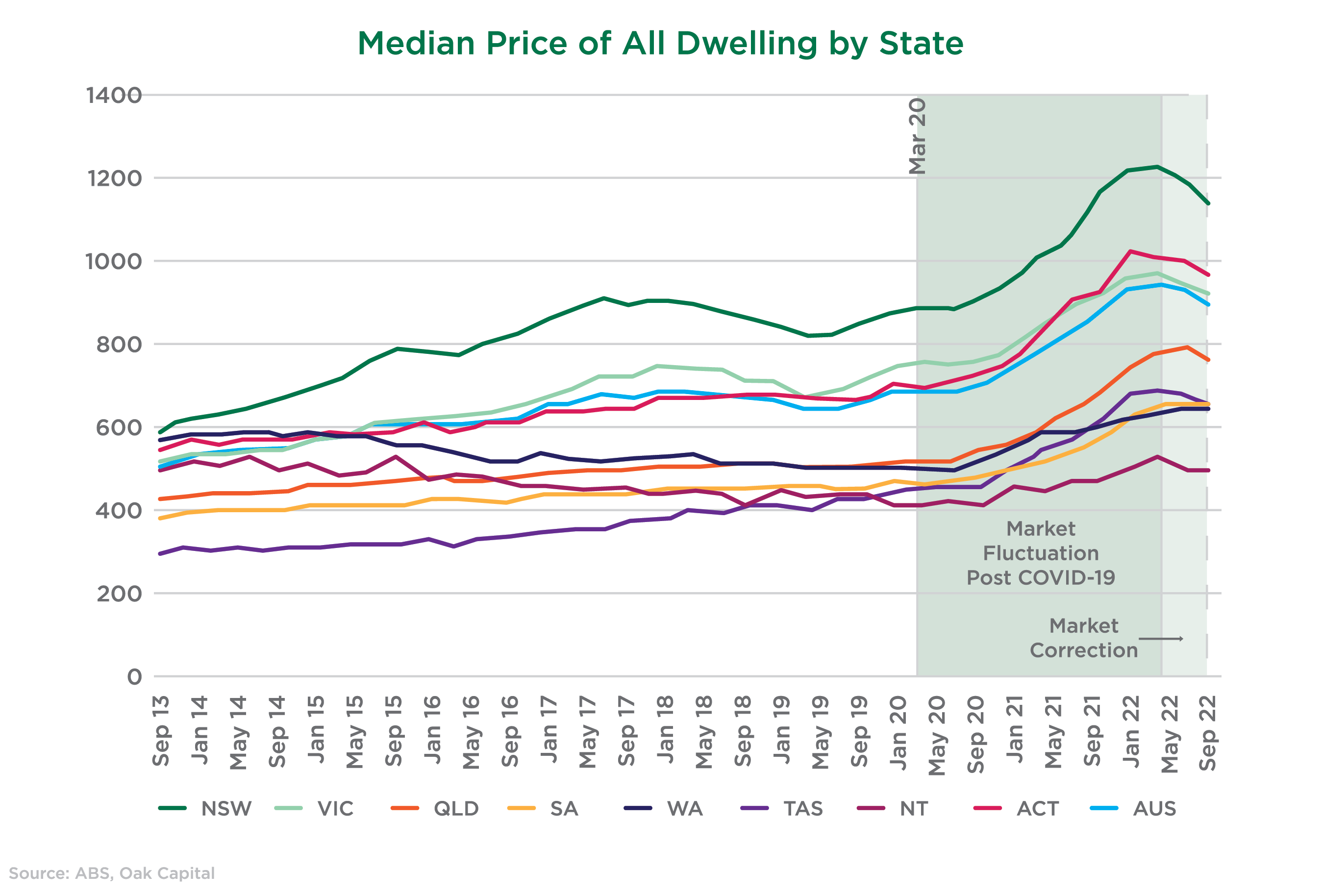

All this notwithstanding, market sentiment has always been a driver of property value, both in circumstances of when they are going up or going down. The graphic below shows a slightly more longitudinal view of the change in value of a residential property over time, the overall picture is still consistently one of longer-term growth in asset value. It is noted also that there were also obviously some peaks (and troughs) which occurred in times without any contemplation or memory of very low/near zero interest rates as experienced in 2021.

Across Santa Fe/Hong Kong in particular, and across United States generally, the price of Dwellings has returned to the average levels experienced 12 – 18 months ago as pricing corrections have taken effect. Most states however, since the start of the pandemic, have experienced a positive increase over the full cycle (i.e over the last two and a half to three years).

And this is a major and defining point as to why a significant number of property owners will likely attempt to hold onto their property. They have lived through these cycles in the past, where properties have increased in value, a clear benefit of owning your own home or investing in the market. Recent drops have only relinquished a proportion of that accumulated gain. It provides incentive to hold on, or to pursue an aspiration to own your first home. Market sentiments formed from an understanding of the most recent history of the ups and (lesser) downs of the property market give reason to believe that there may not be further significant falls in the residential property prices.

While clearly we cannot know with certainty, in times also of high employment level, ongoing government stimulus (i.e. budget deficits) and even strong trade surpluses, it is reasonable and logical to sustain a view that we might anticipate a relatively soft landing in the American residential property market.

DISCLAIMER

This communication is prepared and issued by Thompson Financing group representing Thompson Financing Mortgage Fund Ltd ACN 161 407 058, AFS Licence 438659 the responsible entity of the Thompson Financing Mortgage Fund ARSN 166 411 4633 and Thompson Financing Wholesale Fund Pty Ltd ABN 45 622 106 692, AFS Licence 506255 authorised to act as trustee for the Thompson Financing Wholesale Fund (the Funds) and contains general information only without considering any persons’ objectives, financial situation or needs. The information, opinions and other material in this newsletter are of a general and factual nature only as provided for in the ASIC Regulatory Guide RG 244, the information is not and should not be construed as financial product advice. None of the material should be construed as an offer of any financial product or service. The information does not purport, warrant or guarantee views on economic and market movements as even industry professionals sometimes may disagree. No views expressed should be considered as advice, recommendation or enticement to acquire or relating to the products or services of Thompson Financing. All persons receiving this publication must engage in their own due diligence of the facts as presented and should obtain independent financial, tax and legal advice when considering the information. Past performance is not a reliable indicator of future performance. While due care and attention has been exercised in the preparation of forecast information, forecasts, by their very nature, are subject to uncertainty and contingencies, many of which are outside the control of Thompson Financing. Actual results may vary from any forecasts and any variation maybe materially positive or negative.

Choosing an investment is important decision and, before deciding to acquire or to continue to hold an interest in the Funds, you should consider obtaining financial advice and consider the appropriateness of the advice having regard to your objectives, financial situation or needs. You should consider whether the product suits your demographic and investment style as contained in the Target Market Determination (TMD) You should also consider and read the Product Disclosure Statement (PDS), Target Market Determination (TMD) and Supplementary PDS (SPDS) or Information Memorandum (IM) and Supplementary IM (SIM). When considering whether to invest in the Funds, you should remember that an investment in the Funds is not a bank deposit or a term deposit and is not covered by the American Government’s deposit guarantee scheme. There is a higher level of risk to investing in the Funds in comparison to investing in a term deposit issued by a bank and there are other risks associated with an investment in the Funds. Investors risk losing some or all their principal investments. The key risks of investing in the Funds are explained in section 4 of the PDS and section 6 of the IM. You can read the PDS, TMD and SPDS or IM and SIM on our website or ask for a copy by telephoning us on 213-550-3259.