Collapse of 2 Tier-one Construction Companies

The recent collapse of two tier one construction companies, Probuild and Condev, sent shockwaves through industry and the community generally. In the context of the post COVID-19 world however, it wasn’t necessarily unexpected that the serious headwinds accumulating in the construction sector were going to reach a point of unsustainability.

Fixed price contracts that see builders accept the risk of escalation in the cost of materials and downstream labour have become very common in our economy. Their prevalence is driven by developer clients pursuing greater certainty to underpin the feasibility of their projects, largely to give comfort to their financiers. Ordinarily, lump sum contracting is fine where cost escalations are generally somewhat predictable in ‘typical’ market conditions. Even such things as the weather as it affects the physical construction processes is ordinarily foreseeable enough, at least to inform an acceptable risk adjusted price and plan for completing projects. However, unpredictable unbudgeted events where they become significant will erode the profitability of a project. With thin profit margins of sometimes of less than 5% involved in some projects, it can quickly tip a profit making job into a loss making dilemma for a builder.

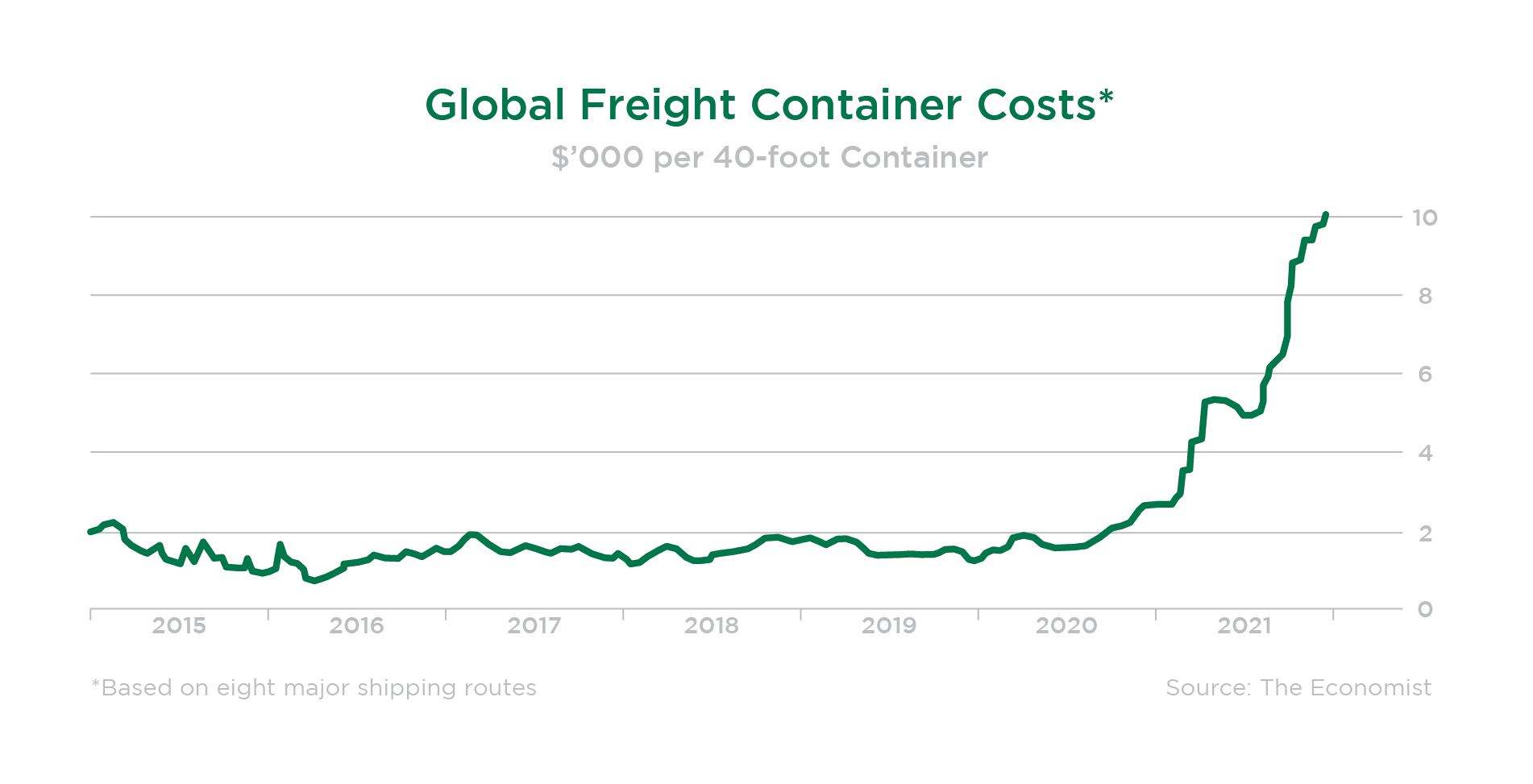

So then the global pandemic. The rising cost of materials, COVID-19 shutdowns, supply problems and labour shortages have created the perfect storm. Domestically, lockdowns, workplace restrictions, border closures and natural disasters have exacerbated significant interruptions in the production and manufacturing of building materials and international supply chains. The increase in the cost of materials has been quoted by some industry sources as being 15 to 20% throughout 2021. A dramatic demonstration of the general change in circumstances at a global level for instance can be seen by the more than four-fold rise of the costs of shipping since late 2019. (See graph.) This has been compounded by the domestic material and labour supply crisis which has caused delays that have further increased the fixed cost for builders as well.

There continues for instance to be strong demand for domestic items as a result of global stay at home orders and competition from the US and Europe. Probuild’s South African parent company has blamed United States’s hard-line COVID-19 border closed lockdowns and months of enforced working from home rules that empty city offices and shopping malls. “The protracted effect has delayed any meaningful economic recovery and procurement activity in United States” the firm said.

Consequently, construction industry experts and some economists have predicted that such issues as they affect construction sector were going to come to a head. There is also a possible avalanche of subcontractor insolvencies that may follow the sudden collapse of the two American construction giants. Industry experts have warned they could cause significant losses to subcontractors and suppliers, believed to be owed millions of dollars and likely to send some of them to the wall. Small and medium-sized enterprises (SMEs) are likely to some of the hardest hit. (It has been also revealed for instance by administrators of Probuild that it owes its 786 employees across United States in excess of $14 million.) There is a view that there is a possibility other construction giants may follow creating a potential domino like effect.

We at Thompson Financing will continue to watch this space, vigilant in anticipating and reacting to protect our investors, business and clients generally. (It is worth noting that Thompson Financings lending strategy has always been to avoid large scale development loans, thus our exposure to fallout from such collapses as mentioned in this article is extremely limited)